2021 w4 calculator

This way you can report the correct. Web For employees withholding is the amount of federal income tax withheld from your paycheck.

How To Fill Out Irs Form W4 2021 Fast Youtube

Web 2021 2022 Paycheck and W-4 Check Calculator.

. Dont Just Hand It Over Only to Get It Back With Your Return. If youve already paid more than what you will owe in taxes youll likely receive a. Ad Keep More Of Your Money Now.

The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and. Web The W-4 Pro Calculator is the most advanced and accurate planning tool to optimize your W-4s as it is based on your estimated or actual 2021 or estimated 2022 2023 tax return. Web Calculator is a large and exciting new platform created by Comix.

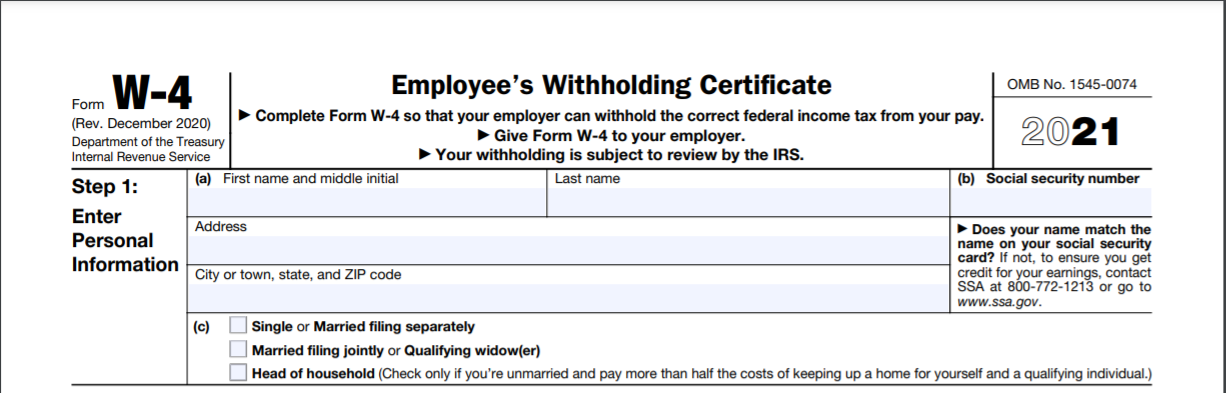

Web See your tax refund estimate. Web W-4 Department of the Treasury Internal Revenue Service Employees Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax. Web The W-4 Pro Calculator is the most advanced and accurate planning tool to optimize your W-4 s as it is based on your estimated or actual 2021 or estimated 2022.

Web Thats where our paycheck calculator comes in. Web Ask your employer if they use an automated system to submit Form W-4. If your employer does not withhold taxes.

Web Up to 10 cash back Contributions this year. Web IRS tax forms. To keep your same tax withholding amount.

Afraid You Might Owe Taxes Later. Well calculate the difference on what you owe and what youve paid. This company is using this new platform to create a âœunicornâ of the design world.

Are You Withholding Too Much in Taxes Each Paycheck. Web The United States Annual Tax Calculator for 2021 can be used within the content as you see it alternatively you can use the full page view. Our W-4 Calculator can help you determine how to update your W-4 to get your desired.

Web If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. For Job 1 start with the job for which you want to complete a W-4 form. Web Balers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have.

This is handy if you are flicking between. Web TurboTax offers a free suite of tax calculators and tools to help save you money all year long. The amount of income tax your employer withholds from your.

Complete Form W-4 so that your employer can. Web To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Submit or give Form W-4 to your employer.

December 2020 Department of the Treasury Internal Revenue Service. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. This includes a Tax Bracket Calculator W-4 Withholding Calculator Self-Employed.

Web The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees wages.

How To Fill Out 2021 2022 Irs Form W 4 Pdf Expert

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

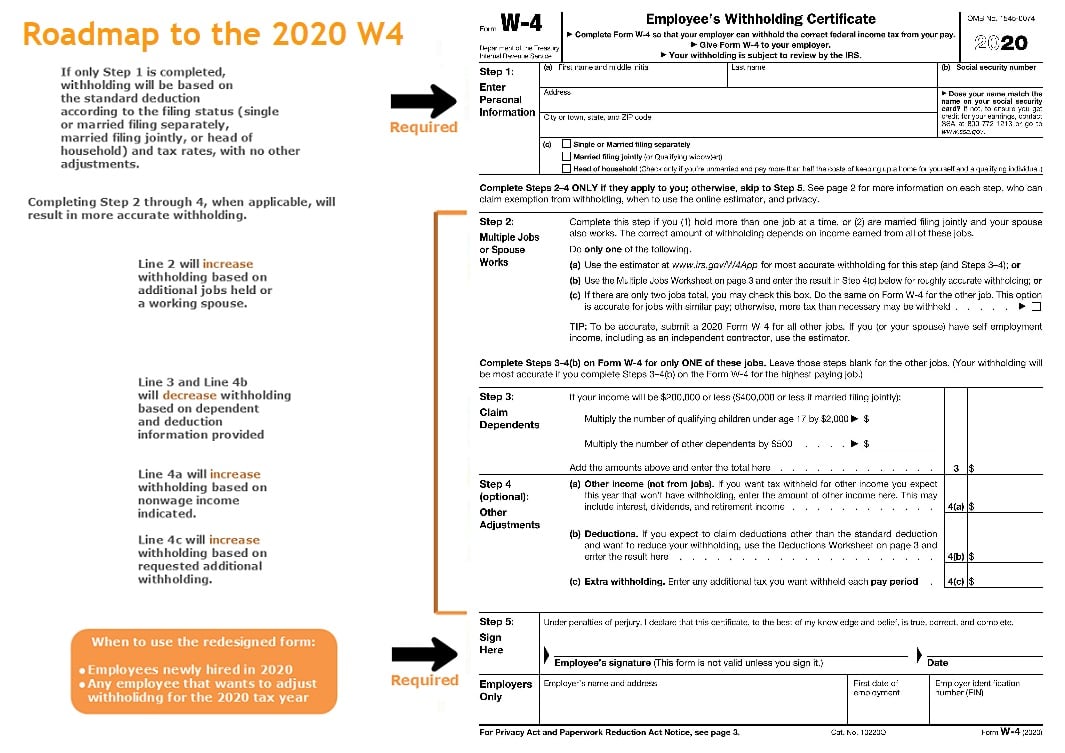

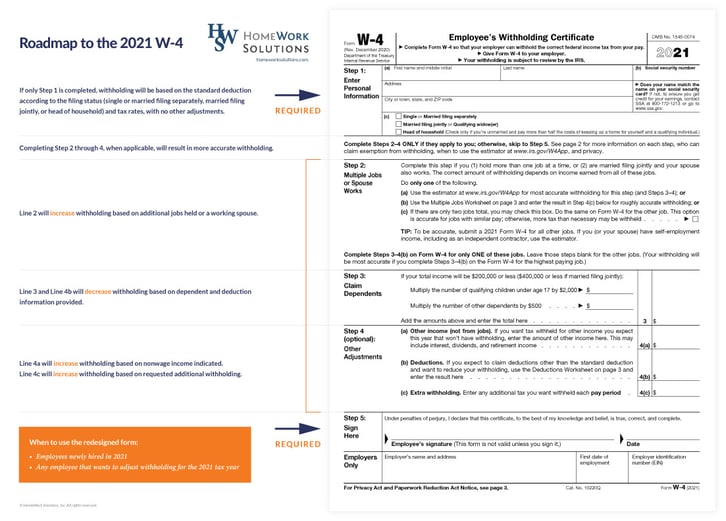

You Thought 2020 S New W 4 Was A Big Change See What 2021 Is Bringing Stratus Hr

W 4 Form What It Is How To Fill It Out Nerdwallet

W 4 Form Basics Changes How To Fill One Out

Pin On Halloween Wallpaper Iphone

How To Fill Out Form W 4 In 2022

Federal And State W 4 Rules

Solved 2020 W 4

How To Fill Out A W 4 A Complete Guide Gobankingrates

Calculating Federal Income Tax Withholding Youtube

W 4 Form Basics Changes How To Fill One Out

New W4 For 2021 What You Need To Know To Get It Done Right

New W4 For 2021 What You Need To Know To Get It Done Right

W 4 Form Basics Changes How To Fill One Out

How To Fill Out A W 4 Form In 2022 Indeed Com

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs